e-Invoicing in Malaysia: Your Ultimate Guide to Streamlined Business Transactions

- eric kong

- Mar 27, 2024

- 4 min read

Updated: Mar 28, 2024

In today's rapidly evolving digital landscape, businesses in Malaysia are embracing the transformative power of e-Invoicing. As the Malaysian government takes significant strides towards implementing e-Invoicing nationwide, it is crucial for businesses to stay informed and prepared for this game-changing transition. In this comprehensive guide, we will dive deep into the world of e-Invoicing in Malaysia, exploring its benefits, implementation timeline, best practices, and how it will revolutionize the way businesses operate.

What is e-Invoicing in Malaysia?

e-Invoicing, or electronic invoicing, is a digital method of creating, transmitting, and storing invoices. In Malaysia, e-Invoices are generated in a standardized format specified by the Inland Revenue Board of Malaysia (IRBM), allowing for seamless processing and validation. This digital proof of transaction replaces traditional paper-based invoices, credit notes, and debit notes, ushering in a new era of efficiency and transparency.

What is the process flow of e-Invoice in Malaysia?

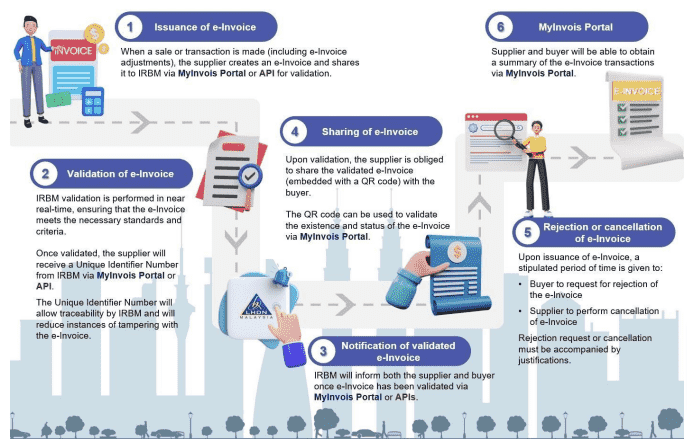

The process flow of e-Invoicing in Malaysia involves several key steps that ensure efficient and secure transmission of invoices between sellers and buyers. Here's a detailed breakdown of the e-Invoice process flow:

Transaction Occurrence: The e-Invoicing process begins when a transaction takes place between a seller and a buyer, such as the sale of goods or services.

e-Invoice Creation: Following the transaction, the supplier creates an e-Invoice using their internal systems or e-Invoicing software. The e-Invoice must adhere to the standard format specified by the Inland Revenue Board of Malaysia (IRBM) and contain all the mandatory fields.

e-Invoice Submission: The supplier sends the generated e-Invoice to the IRBM through one of two methods:

MyInvois Portal: The supplier can manually upload the e-Invoice to the IRBM's MyInvois portal.

API Integration: The supplier's e-Invoicing software can directly transmit the e-Invoice to the IRBM via an Application Programming Interface (API).

e-Invoice Validation: Upon receiving the e-Invoice, the IRBM validates the invoice by checking the mandatory fields and other essential details. This validation process ensures the accuracy and completeness of the e-Invoice.

Notification to Supplier and Buyer: After the validation process, the IRBM notifies both the supplier and the buyer about the status of the e-Invoice. This notification confirms that the e-Invoice has been successfully validated and accepted by the IRBM.

QR Code Embedding: Once validated, the supplier is responsible for embedding a QR code on the e-Invoice. This QR code contains essential information about the invoice and allows for quick and easy verification.

Sharing with the Buyer: The supplier then shares the e-Invoice, complete with the embedded QR code, with the buyer. This can be done through various means, such as email or a designated portal.

Storage and Retrieval: Both the supplier and the buyer can access and retrieve the e-Invoice summary through the MyInvois Portal. This allows for easy tracking and management of e-Invoices.

Throughout the process flow, the IRBM plays a central role in validating and facilitating the exchange of e-Invoices between suppliers and buyers. This streamlined process ensures transparency, efficiency, and compliance with the e-Invoicing regulations set by the Malaysian government.

By following this process flow, businesses in Malaysia can seamlessly transition to e-Invoicing, reducing manual errors, saving time and resources, and contributing to the overall digitalization of the economy.

Why Implement e-Invoicing in Malaysia?

The Malaysian government's decision to adopt e-Invoicing aligns with its vision of fostering a thriving digital economy and enhancing tax administration efficiency. By embracing e-Invoicing, businesses can:

Streamline invoicing processes and reduce manual errors

Save time and resources on tax compliance

Enhance ease of business for entities engaged in international trade

Prevent tax leakage and promote transparency

e-Invoicing Implementation Timeline

To ensure a smooth transition, the IRBM has outlined a phased approach for e-Invoicing implementation based on annual turnover:

Phase 1 (1 August 2024): Businesses with annual turnover > RM 100 million

Phase 2 (1 January 2025): Businesses with annual turnover > RM 25 million and up to RM 100 million

Phase 3 (1 July 2025): All taxpayers

Navigating the Challenges and Embracing Best Practices

While e-Invoicing brings numerous benefits, businesses may face challenges during the transition. These include regulatory compliance, technological readiness, data security concerns, and resistance to change. To overcome these hurdles, businesses should:

Assess their e-Invoicing readiness and compatibility with existing systems

Familiarize themselves with e-Invoicing guidelines and requirements

Choose the right integration method and experienced vendor

Prepare a diverse project team to drive the e-Invoicing implementation

Conduct regular reviews to assess performance and prevent errors

The Role of e-Invoicing Across Industries

e-Invoicing is set to transform various industries in Malaysia, from healthcare and construction to telecommunications and e-commerce. As the implementation progresses, the IRBM will release industry-specific FAQs to guide businesses through the transition, ensuring a seamless adoption across sectors.

Partnering with Biztrak and GRITC for Seamless e-Invoicing

To simplify the e-Invoicing journey, businesses can partner with trusted solutions providers like Biztrak and GRITC. With their expertise in accounting software and IT consulting, respectively, Biztrak and GRITC offer comprehensive e-Invoicing solutions that ensure compliance and efficiency.

Embracing the Future of Business Transactions

As Malaysia moves towards a digital future, e-Invoicing is a critical step in transforming business transactions. By staying informed, prepared, and partnering with the right solutions providers, businesses can navigate this transition with confidence and unlock the full potential of streamlined, transparent, and efficient invoicing processes.

Stay ahead of the curve and embrace the power of e-Invoicing in Malaysia. Discover how Biztrak and GRITC can help you simplify your e-Invoicing journey and thrive in the digital age.

Comments